Source: IRS.gov

IRS reminder to many: Make final 2022 quarterly tax payment by Jan. 17; avoid surprise tax bill, possible penalty

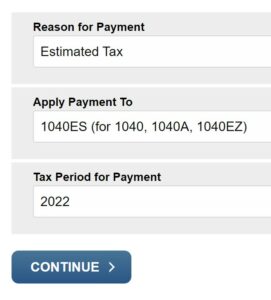

WASHINGTON − The IRS urges taxpayers to check into their options to avoid being subject to estimated tax penalties, which apply when someone underpays their taxes. Taxpayers who paid too little tax during 2022 can still avoid a surprise tax-time bill and possible penalty by making a quarterly estimated tax payment now, directly to the Internal Revenue Service.

Income taxes are pay-as-you-go. This means that taxpayers need to pay most of their tax during the year as income is earned or received. There are two ways to do this:

- Withholding from paychecks, pension payments and some government payments, such as Social Security benefits or unemployment compensation. Most people pay their tax this way.

- Making quarterly estimated tax payments throughout the year to the IRS. Self-employed people and investors, among others, often pay tax this way.

Act now to avoid a penalty

Either payment method–withholding or estimated tax payments–or a combination of the two, can help avoid a surprise tax bill at tax time and the accompanying penalty that often applies.

If a taxpayer failed to make required quarterly estimated tax payments earlier in the year, making a payment soon to cover these missed payments will usually lessen and may even eliminate any possible penalty. Because the penalty calculation considers the date on which the payment or payments were made, even making a payment now, rather than waiting until the April filing deadline, often helps.

Who needs to make a payment

People who owed tax when they filed their 2021 tax return may find themselves in the same situation again when they file for 2022. This will likely be true, especially if they failed to take action to avoid another shortfall by increasing their withholding during 2021.

People in this situation often include those who itemized in the past but are now taking the standard deduction, two wage-earner households, employees with non-wage sources of income and those with complex tax situations. |