Financial Resources for Everyone during Coronavirus Pandemic

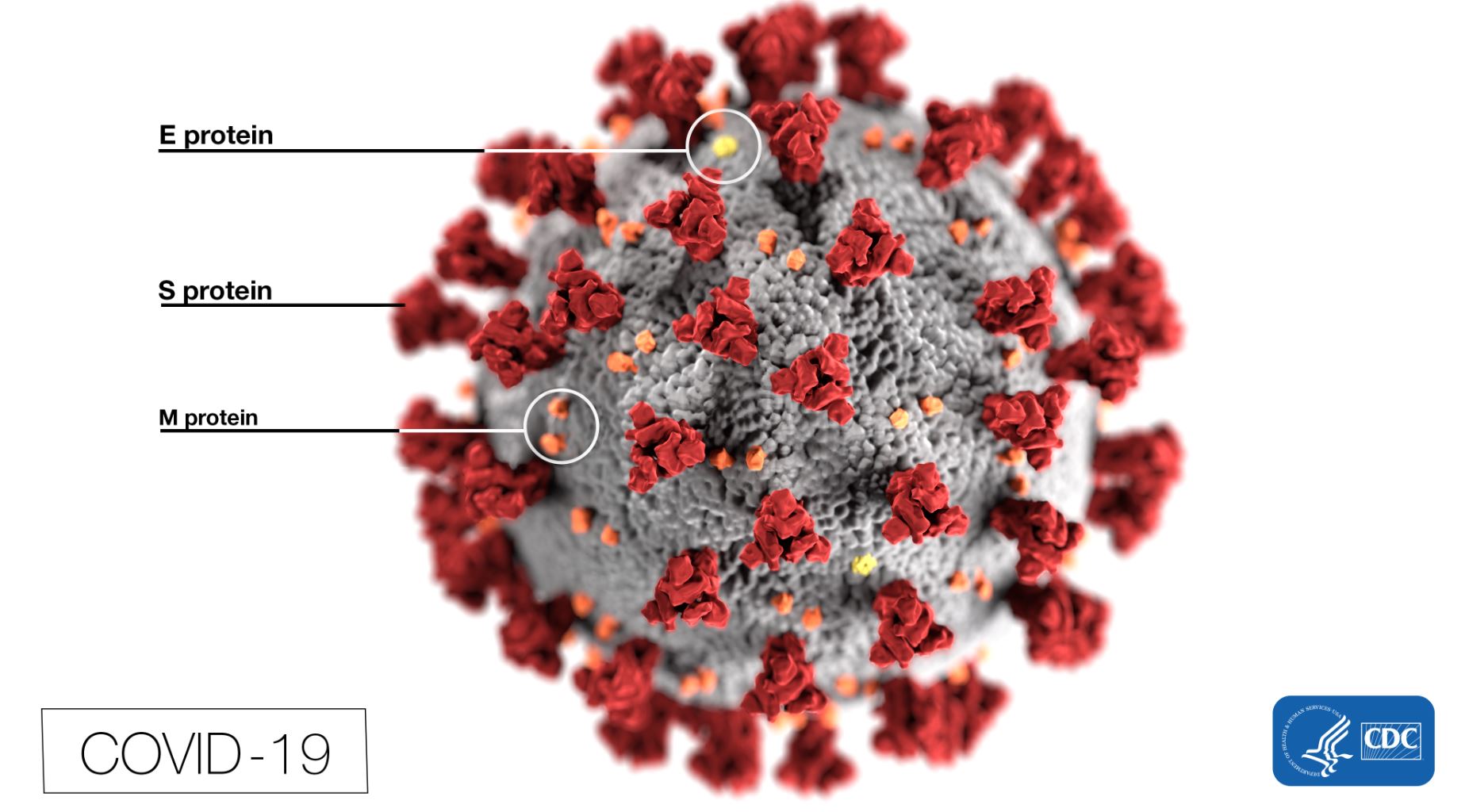

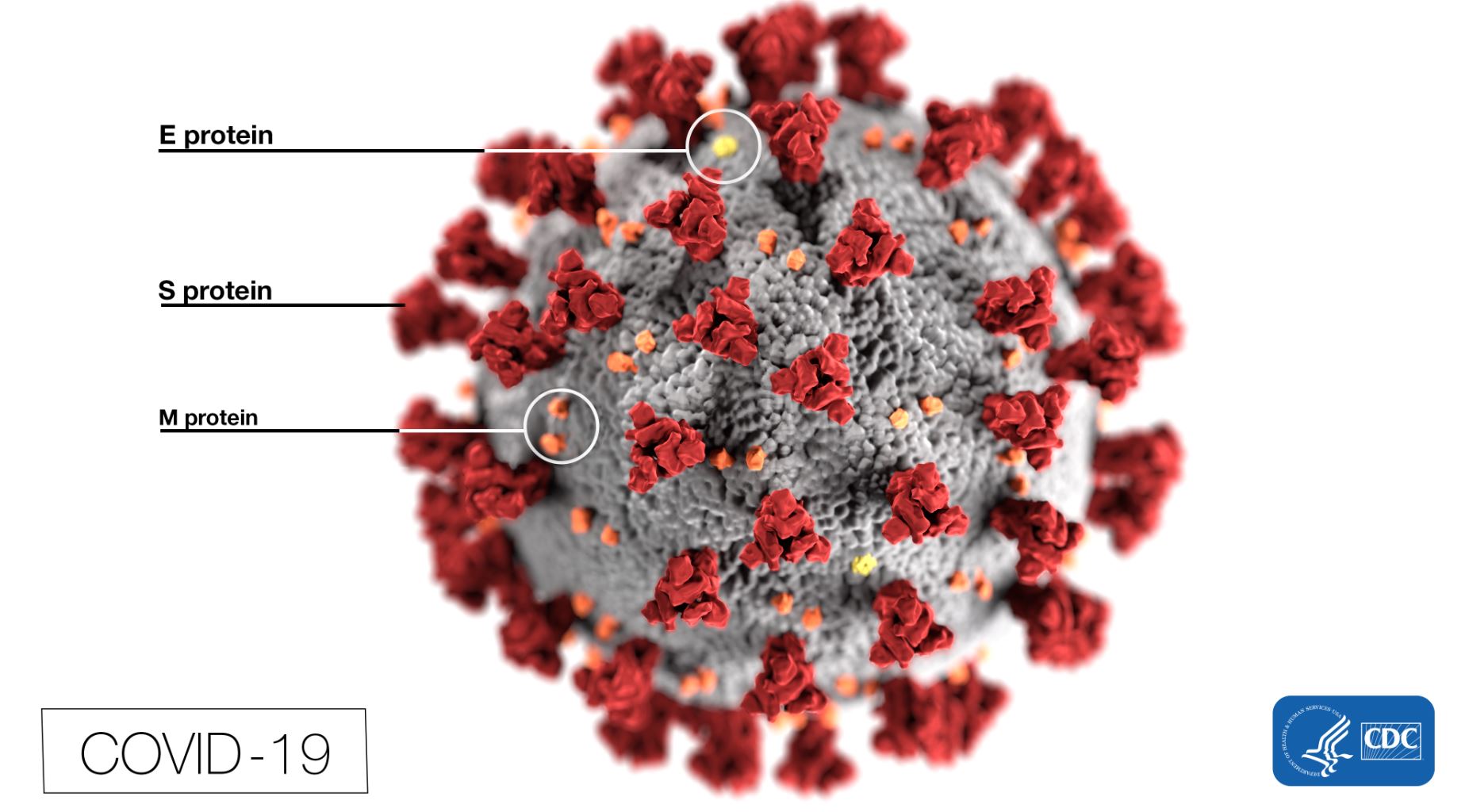

At AFSG, we know that the novel coronavirus (COVID-19) has not spared anyone. Individuals, families, small businesses, gig-workers, sole-proprietors, employers... Everyone has been impacted by this pandemic. Finding the most current information has been tough. We will try to keep this webpage as up to date as possible with FACTS, [...]